Implementation Accounting in Software Engineering

In a course like Implementation Accounting in Software Engineering, the topics generally blend accounting principles with software engineering practices. Here’s a breakdown of what could typically be covered:

1. Introduction to Accounting & Software Engineering

Overview of Accounting Principles (IAS & IFRS also GAAP)

Introduction to Software Engineering Basics

The role of accounting in software development projects.

2. Financial Reporting in Software Projects

Applying accounting standards (IAS/IFRS, GAAP) to software engineering

Revenue recognition for software contracts

Cost accounting for software projects (capitalization of development costs, R&D)

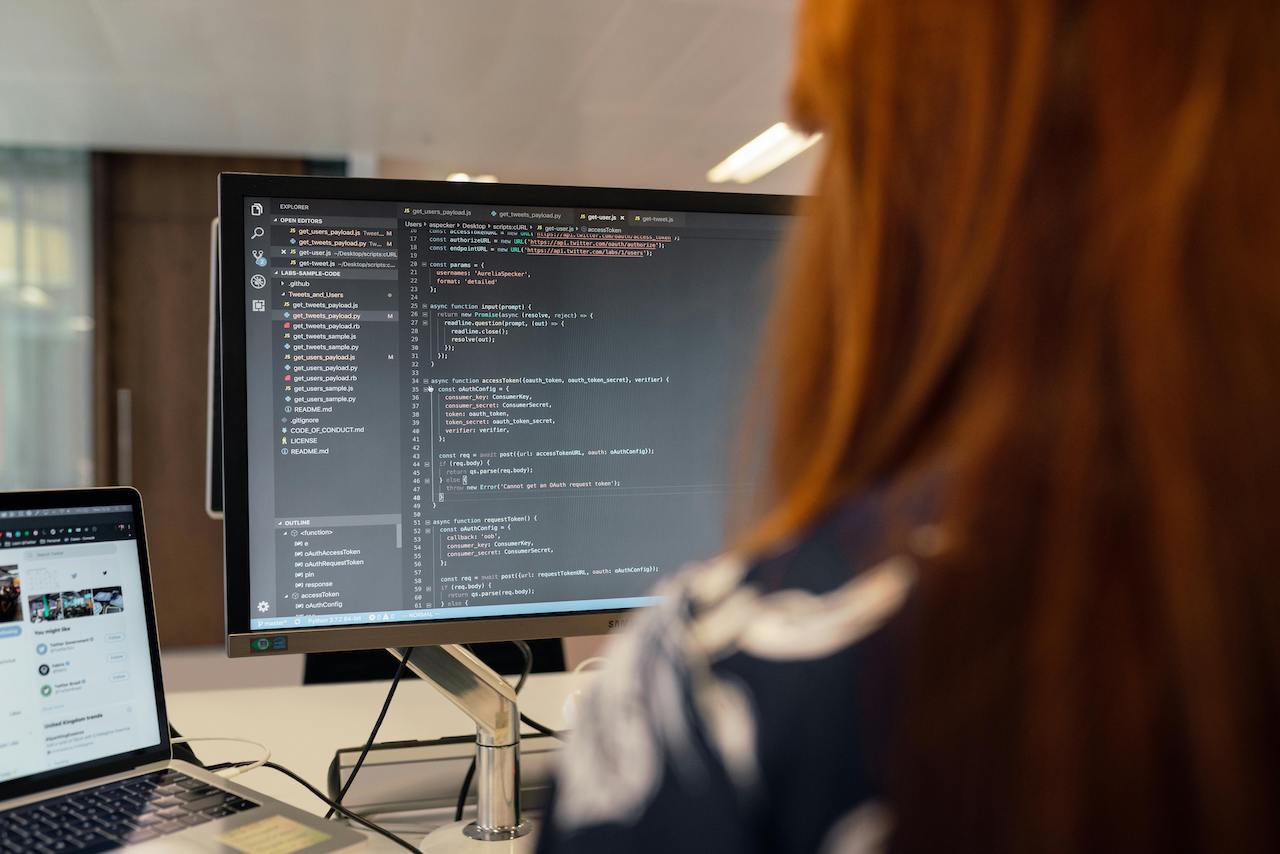

3. Software Tools for Accounting

Practical use of accounting software (QuickBooks, Xero and Other Accounting Software)

Integration of accounting systems with software development tools (e.g., JIRA, Git)

Automating financial processes in software projects.

4. Budgeting & Cost Management

Project cost estimation and tracking

Managing software project budgets and forecasts

Dealing with cost overruns and financial risks in software serservices

. Auditing & Compliance

Ensuring financial transparency and compliance with accounting regulations (SOX, IFRS 15)

Internal auditing practices for software companies

Risk management in financial reporting.

6. Implementation of Accounting Systems in Software Firms

Software development life cycle (SDLC) in relation to accounting

Customizing accounting software for industry needs

ERP systems and financial modules (SAP, Oracle Financials)

7. Revenue Models in Software Engineering

Subscription models, SaaS accounting

Understanding licensing and royalties in financial reporting

Long-term contract accounting for software services

8. Financial Analytics & Reporting

Generating financial reports for decision-making

Financial KPIs and dashboards for software development

Using data analytics to predict financial performance in software projects

9. Taxation & Regulatory Issues

Tax implications in software development (R&D credits, VAT/GST on digital goods)

Managing cross-border financial transactions in software engineering

Compliance with global tax laws and regulations for software businesses

10. Case Studies and Practical Projects

Real-world application of accounting systems in software projects

Group projects and case studies to implement accounting in software development scenarios

These topics provide a comprehensive foundation for professionals looking to bridge the gap between accounting and software engineering, focusing on practical, hands-on experience.

*6 Months Prime Internship Opportunity.

Why you waiting then? 1 Course All Solutions.